In something between one and two generations we’ve gone from the single income family being the standard to the two income family. You might think this would result in an increase in average family financial security. It’s not true. You might also think that the fact that this isn’t true is because of overspending and consumption on the part of the middle class–everyone with a McMansion, big screen TV, and leveraged to the hilt:

But is this argument true? If families really are blowing their paychecks on designer clothes and restaurant meals, then the household expenditure data should show them spending more on these frivolous items than ever before. But the numbers don’t back up the claim.

A quick summary of the data from the Bureau of Labor Statistics’ Consumer Expenditure Survey paints a very different picture of family spending.

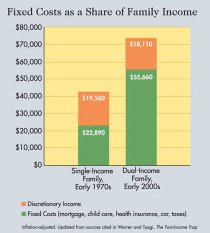

The author of the piece, Elizabeth Warren (incidentally the Gottlieb professor of law and faculty director of the Judicial Education Program at the big H), proceeds to take apart specific segments of the argument, but the accompanying graph really nails the point about what has happened over the last thirty years:

Or, in words:

But higher expenses have more than eroded that apparent financial advantage. Their annual mortgage payments are more than $10,500. If they have a child in elementary school who goes to daycare after school and in the summers, the family will spend $5,660. If their second child is a pre-schooler, the cost is even higher—$6,920 a year. With both people in the workforce, the family spends more than $8,000 a year on its two vehicles. Health insurance costs the family $1,970, and taxes now take 30 percent of its money. The bottom line: today’s median-earning, median-spending middle-class family sends two people into the workforce, but at the end of the day they have about $1,500 less for discretionary spending than their one-income counterparts of a generation ago.

I think there’s still a big open question about the mortgage aspect: as I’ve mentioned earlier I think “the people” are guilty of both getting more house than they need (or can sanely afford), and worse, of not understanding the degree of risk that they are taking on. However, setting aside the mortgage question, the rest of the article presents an interesting view on the modern dual income world.