While I was in Boston last week I took advantage of the relative strength of the Canadian dollar versus the US dollar to purchase a pretty large set of stuff. I made a 32 item order from Amazon, which I had delivered to a friend’s house, and I suspect the savings of doing this were vast: I got the benefit of the exchange rate, the benefit of the fact that the Canadian prices tend to be unreasonably higher at the moment as the market lags behind the dollar, and of course I saved paying sales tax on the items. At some point I should figure out exactly how much I saved–perhaps in a later post.

Despite the recent mad rush of shopping across the border to take advantage of these things, I still had no more trouble than usual smuggling my crate of books across the border–although I certainly worried about it more this time than I usually do.

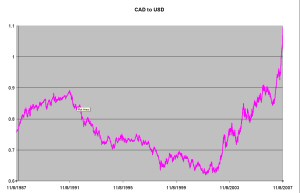

It looks like I hit a local maxima in the value of the dollar, too, which pleases me:

Thinking about that got me thinking (again, I’ve thought about it a lot before) about the relative values of the currencies of our two nations, and if there’s any rationality in how they fluctuate.

Before I got into my theorizing about the whys and wherefores, I thought I better have some good data to start from.

To that end I did a bunch of research and assembled a spreadsheet of the exchange rates for every day going back twenty years. (As an aside, one of the funniest things I ran into when doing this was the main exchange table at xe.com: the US-to-Canadian box in the table has a little “help” icon that pops up a message that says, essentially, “Yes, really, the Canadian dollar is worth more. You are not crazy.” If they happen to change it I’ve preserved a screenshot for posterity.)

From this spreadsheet I was then able to create a graph showing the performance of the Canadian dollar against the US dollar over the last 20 years. It really makes it clear how shocking the recent rise in the relative value of the dollar is:

I note that my full-time professional career started, and was fully-established in that period where the Canadian dollar was worth less (often much less) than 80 cents. Since I’ve always worked for American firms, this means I was “cheap” for them. Additionally, several of my largest raises came during that period when the dollar was well under 70 cents–I’m pretty sure that on at least a couple of occasions I got a pretty decent raise, and I was still effectively cheaper to the company than before the raise. On the other hand, over the last five or six years, the US purchasing power of my salary has almost doubled just due to currency–ignoring my actual raises. I am a lot more expensive to the company than I was in 2001. I can also buy a lot more books with my salary than I could in 2001, even with the general rise in prices during the intervening years.

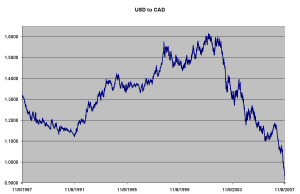

Of course, the obvious corollary to the rise in the Canadian dollar, is that this is matched by a meteoric fall in the US dollar. Indeed, it’s almost certainly true that it isn’t so much that the Canadian dollar is strong, as it is that we’re holding ground while the US dollars weakens and falls, increasingly fast, away from us. Here’s how things look over the last twenty years from the US dollar side:

Now, I’ve just put this basic information together and started looking at it, so any conclusions would be rash. However, in the interest of comedy I do want to point out one thing that leaps out to me as being obvious.

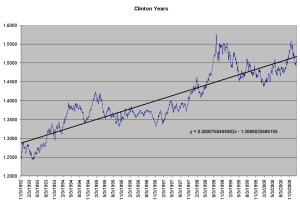

This is the graph showing the performance of the US dollar during what I will call “Clinton’s influence”: the period from his election until Bush’s inauguration. I’ve done a simple linear trendline over this data, and you can see that on average the US gollar got 0.007 cents stronger against the Canadian dollar every day during this period.

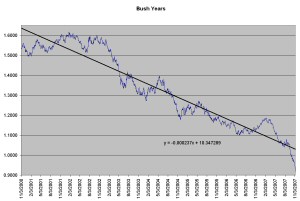

Now here’s the same graph during the period of “Bush’s influence”–again, from his election onwards. (Yes, he will have influence long after he’s gone, and more than just the momentum that Clinton left to Bush, but what else do you call the period of being President-Elect and President?). As you might expect, the linear fit is a little different here, showing that on average the US dollar got 0.023 cents weaker against the Canadian dollar for each day during the period. I haven’t missed a zero there: that’s a drop rate more than three times larger than the growth rate during the Clinton period.

Now I would never be so simplistic as to suggest that it’s as simple as Clinton vs Bush, Dems vs Repubs, or whatever, but you have to admit that the graphs are pretty revealing of at least something.

If you want to play around with the data yourself, you can get the spreadsheet and save the trouble of digging up 20 years of daily exchange rates.

3 comments for “A small discussion on US$ and Canadian$”